Income Verification (IAV)

Income Verification StarterKit

Overview: What is Income Verification?

The Income Verification Starter Kit streamlines the process of verifying a user's income. By securely connecting their bank account, this kit automatically generates an income verification report through our Reports API. The report encompasses both user-level and group-level analyses, detailed in the sections below.

Creating an Income Verification Report

To generate an income verification report, make a POST request to the following endpoint::

POST https://au-api.basiq.io/reportsRequired Headers

When making the request, ensure you include the following headers:

Accept: Specify the response format you expect, typically application/json.Authorization: Include yourBearer tokenfor authentication.Content-Type: Indicate that you're sending JSON data with application/json.

Example Request Headers:

Accept: application/json

Authorization: Bearer your_access_token

Content-Type: application/jsonConstructing Your Request

When constructing your request, you'll need to prepare a JSON payload that specifies the type of report you want to generate, along with any filters relevant to the income verification.

Required Payload Structure

The payload should include:

reportType: The type of report you are generating. For income verification, use"CON_AFFOR_01".title: A descriptive title for the report.filters: An array of filter objects that specify the parameters for your report.

Example Payload:

{

"reportType": "CON_AFFOR_01",

"title": "John Smith Affordability Report 2022-03-26",

"filters": [

{ "name": "fromDate", "value": "2022-01-01" },

{ "name": "toDate", "value": "2023-01-01" },

{ "name": "accounts", "value": ["ag829sj", "aj82gka"] },

{ "name": "users", "value": ["272af9fa-0f4a-44dc-bf88-a63bec2d0662"] },

{ "name": "includeMetrics", "value": ["ME002", "ME003", "ME004"] },

{ "name": "includeGroups", "value": ["INC-001", "INC-002", "EXP-001"] }

]

}Relevant Metrics and Groups

For income verification, the following metrics and income groups are relevant for this use-case:

| ID | Title |

|---|---|

| ME001 | # OF IDENTIFIED SALARY SOURCES |

| ME002 | AVERAGE MONTHLY AMOUNT FROM SALARY |

| ME003 | SALARY HAS BEEN STABLE FOR (MONTHS) |

| ME004 | OTHER POSSIBLE INCOME MONTHLY |

| ME022 | HAS RECENT CHANGES TO SALARY CIRCUMSTANCES |

| ME033 | AVERAGE INCOME MONTHLY |

| ME035 | TOTAL INCOME HAS BEEN STABLE FOR (MONTHS) |

| ME036 | MEDIAN MONTHLY AMOUNT FROM SALARY |

| ME037 | MEDIAN INCOME MONTHLY |

| ME040 | AVERAGE MONTHLY CREDITS |

| ME042 | # OF RECENT INCOME SOURCES |

| ME043 | # OF ONGOING REGULAR INCOME SOURCES |

| ME045 | TOTAL INCOME HAS BEEN SECURE FOR (MONTHS) |

Including All Income Groups

To ensure that your report includes all income groups, even those without data (displaying a value of 0), make sure to specify all relevant groups in the includeGroups filter. This is beneficial as it provides a more comprehensive view of the income landscape.

| ID | Title |

|---|---|

| INC-001 | Benefits |

| INC-002 | Child Support Income |

| INC-003 | Insurance Credits |

| INC-004 | Interest Income |

| INC-005 | Investment Income |

| INC-006 | Other Earnings |

| INC-007 | Other Credits |

| INC-008 | Rent & Board Income |

| INC-009 | Salary |

| INC-010 | Superannuation Credits |

| INC-012 | Youth Allowance |

| INC-013 | Rental Assistance |

| INC-014 | Centrelink |

| INC-015 | Medicare |

| INC-016 | Jobseeker |

| INC-018 | Pension |

| INC-019 | Carers |

| INC-020 | Education |

| INC-021 | Crisis Support |

Use Case: Verifying User Income for Lending

Let's take you through a use case.

Scenario:

A lender needs to verify a user’s income before approving a loan. The user, John, has multiple sources of income that must be considered.

Example:

John is seeking a loan due to financial pressures. He has four distinct sources of income:

- Salary:

- Paid monthly.

- Received $6,000 from January 2023 to May 2023.

- Promoted in June 2023, increasing salary to $8,000 per month (ongoing).

- Rental Income:

- Receives $1,500 fortnightly from a tenant.

- Rental income started in mid-June 2023 due to rising interest rates.

- Child Support:

- Previously received monthly child support.

- Payments stopped after October 2023.

- Interest Income:

- Receives monthly interest from a savings account.

User-Level Analysis:

- Average Monthly Income: John’s average monthly income is $10,061.78.

- Income Stability (Past 12 Months): John’s income has been secure, received generally on time, with minimal fluctuations.

- Income Stability (Past 7 Months): Income has remained stable, with consistent payments and minor variability.

- Current Salary Stability: His salary has been stable for the past 7 months, with no recent changes.

- Projected Income: Based on historical income, three stable income streams are expected to continue, with John projected to earn $11,145 next month.

Metrics:

Below the analysis, display key metric data points like:

- Total monthly income.

- Source-specific income history.

- Projections for next month's income.

This can be seen in this example below:

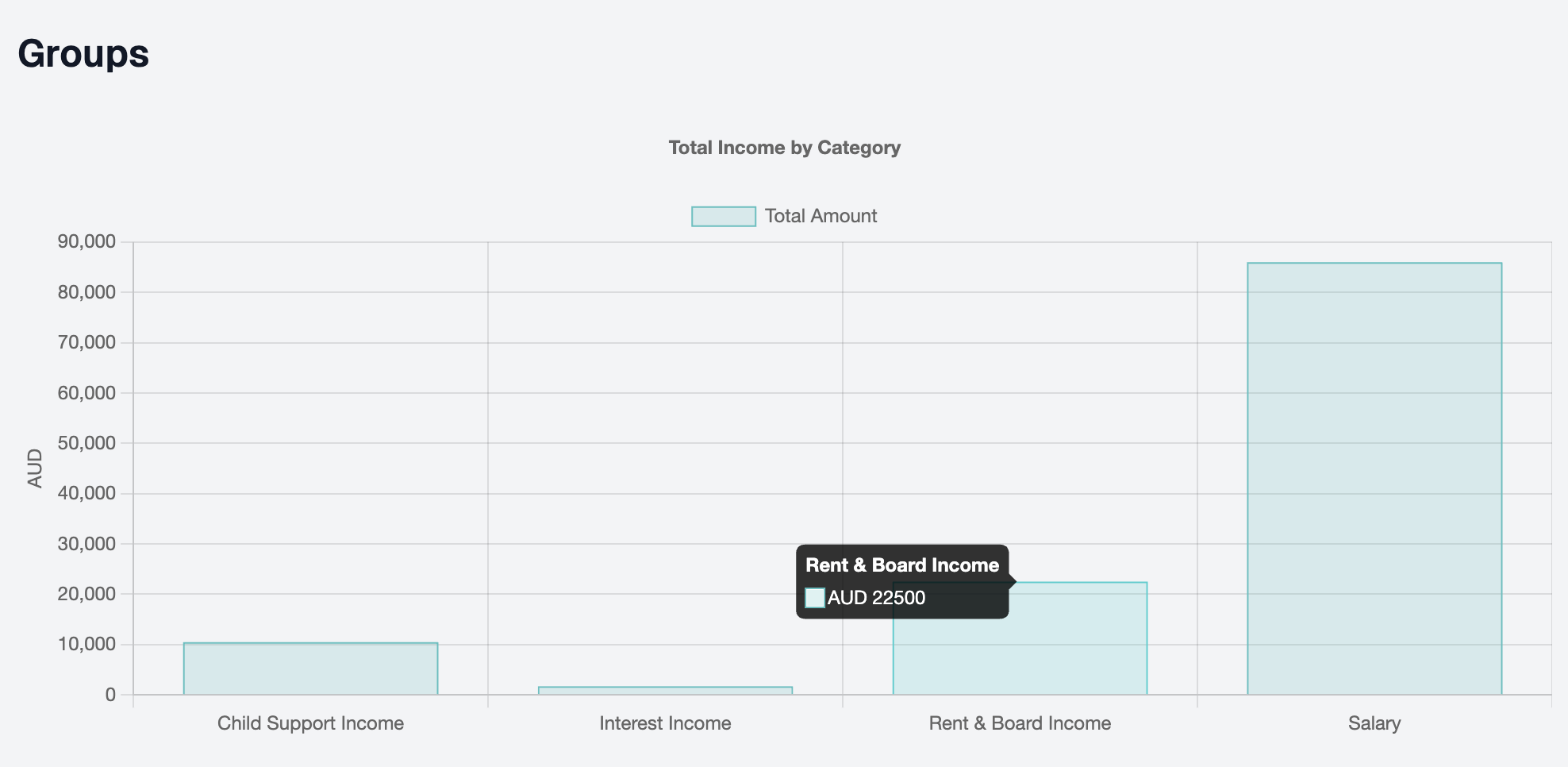

Group-Level Analysis:

For each income source (salary, rent, child support, interest), list detailed group results in a drill-down format. Each section should be expandable for further exploration of the data, allowing the developer to access more granular insights on each income stream.

Income Verification Starter Kit

The Income Verification Starter Kit automates the process of verifying a user’s income. By securely connecting their bank account, the kit generates a comprehensive income verification report using our Reports API, which includes user-level and group-level analysis.

Process Flow:

- User Bank Account Connection: Users securely connect their bank accounts.

- Generate Income Report: After connection, the Reports API will be used to generate a detailed report of the user's income.

- Analysis Metrics:

- The generated report will automatically perform the user-level analysis:

- Average Monthly Income calculation.

- Income Stability for the past 12 months and 7 months.

- Current Salary Stability and projected future income.

- The report will also generate group-level analysis:

- Income breakdown by source (salary, rental, child support, interest).

- Drill-down functionality for each income source, allowing further exploration.

- The generated report will automatically perform the user-level analysis:

Try It Out:

Visit our demo to connect a sample bank account and see the income verification process in action.

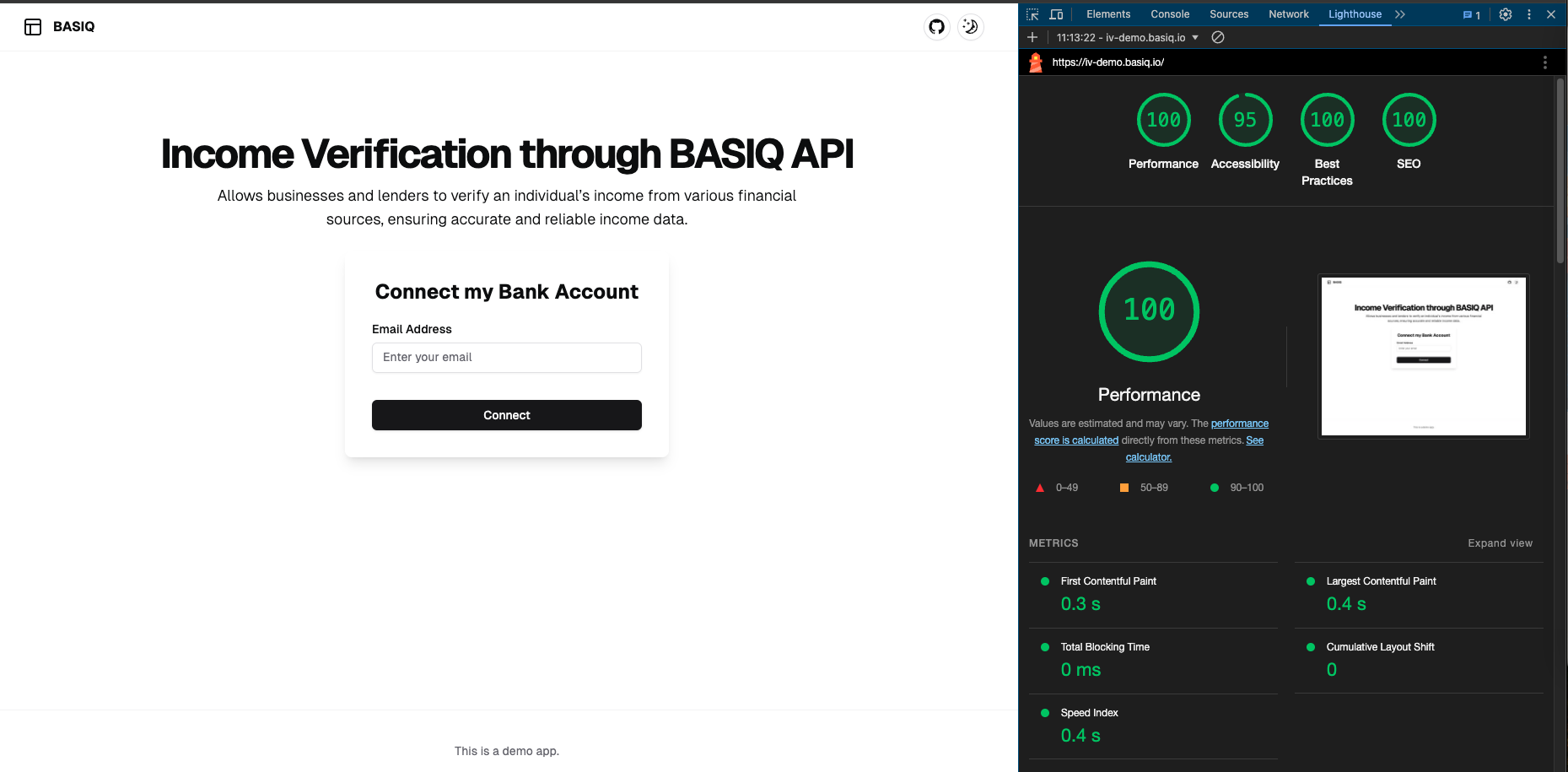

Demo Application Performance

Our Income Verification Demo** is optimised to ensure a high-quality user experience. Below are the results from a Lighthouse audit** conducted on Google Chrome, reflecting top-tier performance in several key areas:

- Performance: 100

- Accessibility: 95

- Best Practices: 100

- SEO: 100

These scores demonstrate the application’s focus on speed, accessibility, and adherence to web standards, ensuring a seamless experience across devices.

Quick Links

- Report API

- Income Verification Starter Kit Demo

📢 Attention! If you have any issues, please reach out to our amazing support team.

Updated 2 months ago